Nonprofit Organizations

The DNA of Schneider Bell includes a commitment to the development and representation of nonprofit organizations.

We have extensive experience in addressing the distinct legal challenges faced by nonprofit entities and continue to serve our community by advancing the mission of every nonprofit we work alongside. Whether you're establishing a new nonprofit or managing an established organization, our team of nonprofit attorneys possesses the specialized expertise and deep understanding of tax-exempt status implications to help you achieve your goals.

-

Kyle Gee

Partner 216.696.4200 x1022

Email -

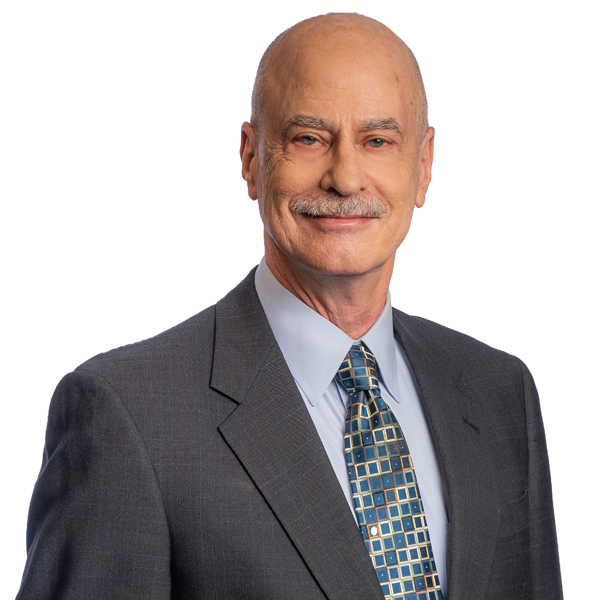

David M. Lenz

Managing Partner 216.696.4200 x1145

Email -

Charbel M. Najm

Associate 216.696.4200

Email -

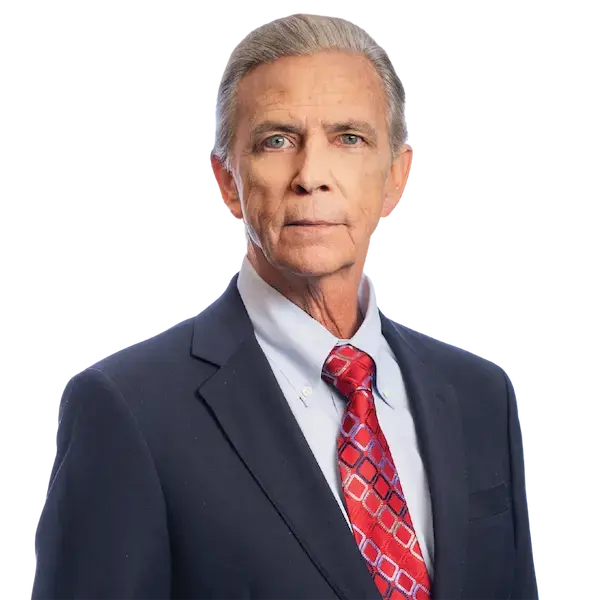

John M. Slivka

Partner 216.696.4200 x1062

Email -

Justin L. Stark

Partner 216.696.4200 x1131

Email -

James D. Vail

Partner 216.696.4200 x1137

Email -

J. Talbot Young, Jr.

Of Counsel 216.215.8325

Email

Nonprofit Navigators: Steering Your Legal Course

From formation to ongoing operations, we assist nonprofit organizations across various sectors, including health care facilities, social services, charities, trade associations, social clubs, and family foundations. Our services include:

- Formation and Tax-Exempt Status: We guide organizations through the formation process and navigate the nuances of obtaining tax-exempt status under state and federal laws. We are innovative and forward-thinking, helping to shape the narrative of the organization’s purpose and activities to ensure compliance with regulatory requirements and maximize benefits associated with nonprofit status.

- Operational Compliance: Once established, we advise on critical operational matters such as private inurement, property tax exemption, public charity status, unrelated business income (UBI), and board governance. We proactively address these matters, helping nonprofits maintain their tax-exempt status and fulfill their missions effectively.

- Commercial, Real Estate, and Employment Law: Beyond nonprofit-specific issues, our nonprofit practice is backed by our full-service firm with a deep bench strength of legal experts in commercial transactions, real estate acquisitions and leases, probate and estate, and employment law matters. Our integrated approach ensures that nonprofits receive holistic legal counsel to support their growth and sustainability.

- Strategic Counsel and Advocacy: We serve as trusted advisors and nonprofit partners, offering skillful counsel to boards of directors and executive leadership. Whether navigating regulatory changes, managing disputes, or exploring new opportunities, we offer customized strategies that align with our clients' organizational missions and values.

- Gift Agreements and Planned Giving: Drawing on our deep estate planning experience, our team has represented either the organization side or the donor side in many transformative charitable gifts. We bring those insights to each potential planned giving strategy and gift agreement, navigating issues such as restricted purposes, donor stewardship reporting, and naming rights, to find true win-win solutions for organizations and donors that drive charitable impact.

Anchor Your Mission with Expert Legal Support

The legal team at Schneider Bell understands the importance of aligning legal strategy with your nonprofit organization's mission. We are dedicated to empowering nonprofits to stay focused on their core purpose while we help them smoothly navigate the intricate legal challenges that come with tax-exempt status. At any stage or age of your organization, we are here to provide legal solutions that support your mission and foster sustainable growth. Contact us today to discover how our experienced team can strengthen your nonprofit's foundation and set you up for lasting success.