Private Foundations

At Schneider Bell, we provide comprehensive legal and tax support for private foundations, helping individuals and families build lasting legacies of charitable impact.

We understand the unique responsibilities and opportunities these entities present. From securing tax-exempt status to guiding ongoing compliance and governance, we are dedicated to ensuring that your foundation achieves its mission effectively and sustainably.

-

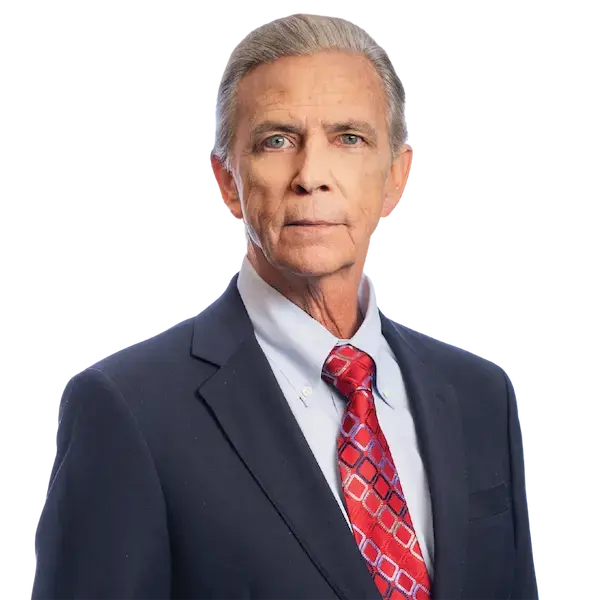

Charles F. Adler

Partner 216.696.4200 x1121

Email -

James R. Bright

Partner 216.696.4200 x1012

Email -

J. Paul Fidler

Partner 216.696.4200 x1113

Email -

Kyle Gee

Partner 216.696.4200 x1022

Email -

David M. Lenz

Managing Partner 216.696.4200 x1145

Email -

Jamie E. McHenry

Partner 216.696.4200 x1016

Email -

Claire Robenalt

Associate 216.696.4200

Email -

John M. Slivka

Partner 216.696.4200 x1062

Email -

Justin L. Stark

Partner 216.696.4200 x1131

Email -

Geoffrey D. Wills

Associate 216.696.4200 x1078

Email -

J. Talbot Young, Jr.

Of Counsel 216.215.8325

Email

What Is a Private Foundation?

A private foundation is a tax-exempt, nonprofit organization that is typically funded by a single individual, family or corporation. Unlike public charities, which actively fundraise, private foundations are generally funded by their founders and use their endowments to support charitable activities, either through direct grants or by running their own programs. Setting up a private foundation offers a structured way to give back to the community, support causes that matter to you and involve future generations in philanthropy.

What Is the Difference Between a Private Foundation and a Family Foundation?

While both private and family foundations are charitable entities with tax-exempt status, they differ primarily in their funding sources and focus.

A private foundation is a broad category that includes any nonprofit organization funded primarily by a single source, such as an individual, family or corporation. Private foundations often manage an endowed pool of assets, use grants to support charitable activities and are regulated under strict IRS guidelines to ensure compliance and prevent self-dealing.

A family foundation is a type of private foundation specifically funded and governed by members of a single family. Family foundations often have a more personal focus on philanthropy, as family members typically serve on the board and actively participate in decision-making concerning recipients of grants from the foundation. The family’s shared values and vision often guide the foundation’s mission and grant-making decisions, making it a meaningful way to pass down philanthropic values across generations.

Family foundations allow for significant flexibility in charitable giving and provide a structured way to support causes over the long-term, fostering a legacy that aligns with the family’s unique values and priorities. Our firm helps families determine whether a family foundation, donor-advised fund or other structure best suits their needs. If a family foundation is the best option, we guide them through every stage of the setup and administration process.

Establishing and Administering Private Foundations

Our team assists clients through every stage of setting up and operating a private foundation. We handle all aspects of foundation formation, including incorporating the foundation, drafting bylaws and securing tax-exempt status from the IRS. Once the foundation is operational, we provide ongoing guidance on essential matters such as fiduciary duties, tax compliance and governance best practices.

We also serve as counsel on specialized issues, including compliance with “self-dealing” and “disqualified person” rules to ensure that your foundation adheres to the highest legal and ethical standards.

Comprehensive Legal Support for Private Foundations

In addition to the establishment of a foundation, we offer a wide range of services to help private foundations thrive and stay compliant. Our services include:

- Grant Administration: Assisting with the review and initiation of grant proposals, ensuring they align with the foundation’s mission and objectives.

- Board Governance and Policies: Helping establish mission statements, investment guidelines and spending policies to provide a clear framework for the foundation’s activities.

- Tax and Regulatory Compliance: Preparing and filing foundation tax returns and advising on tax-exempt matters, including unrelated business income, private inurement and property tax exemptions.

- Meeting Support and Documentation: Attending foundation meetings, preparing necessary documentation and advising on corporate governance to streamline foundation operations.

Navigating Complex Issues Unique to Private Foundations

Private foundations face specific regulatory challenges and responsibilities. Our attorneys provide informed counsel on the tax and fiduciary considerations that arise, including the legal complexities surrounding charitable giving, tax exemptions and IRS compliance. We also help clients address the requirements around private foundation excise taxes, recordkeeping and reporting, ensuring that your foundation maintains its tax-exempt status and fulfills its philanthropic goals.

Why Choose Us for Your Private Foundation?

With a lasting legacy of supporting foundations across Northeast Ohio our firm offers experience and local insight. Time and again, we have helped our clients shape the city in education, economic development, environmental preservation, social services and more. If you’re considering establishing a private foundation or need support for an existing one, reach out to Schneider Bell. We’re here to help you create a legacy of giving that endures for generations.