Estate Planning & Wealth Transfer

Protecting generational wealth is in our DNA.

One of our founding fathers, John M. Henderson, helped incorporate The Cleveland Trust Company and established its Trust Department, setting the foundation for our century-and-a-half long commitment to safeguarding legacies. Our Trusts and Estates practice continues this tradition, crafting sophisticated strategies that ensure your wealth is preserved and passed seamlessly to future generations while minimizing tax liabilities.

-

Charles F. Adler

Partner 216.696.4200 x1121

Email -

James R. Bright

Partner 216.696.4200 x1012

Email -

Jennifer L. Eschedor

Senior Counsel 216.696.4200

Email -

J. Paul Fidler

Partner 216.696.4200 x1113

Email -

Kyle Gee

Partner 216.696.4200 x1022

Email -

Joseph P. Gibbons

Of Counsel 216.696.4200 x1123

Email -

David M. Lenz

Managing Partner 216.696.4200 x1145

Email -

Jamie E. McHenry

Partner 216.696.4200 x1016

Email -

Anna Meredith

Associate 216.696.4200

Email -

Claire Robenalt

Associate 216.696.4200

Email -

John M. Slivka

Partner 216.696.4200 x1062

Email -

Justin L. Stark

Partner 216.696.4200 x1131

Email -

Geoffrey D. Wills

Associate 216.696.4200 x1078

Email -

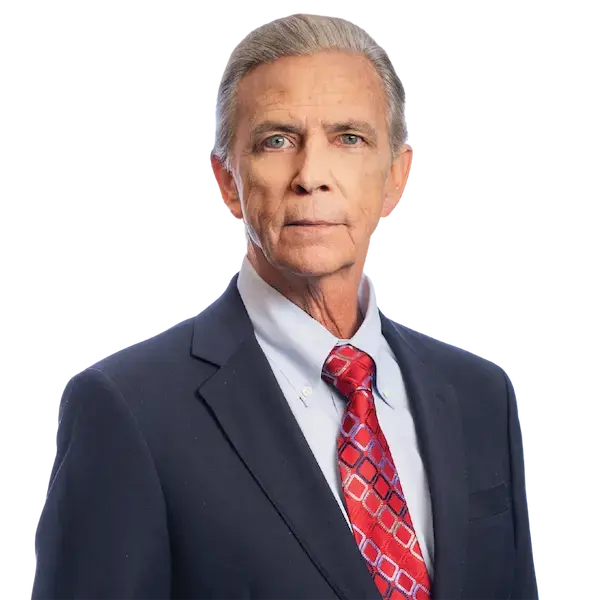

J. Talbot Young, Jr.

Of Counsel 216.215.8325

Email

How Do I Begin My Estate Plan?

Starting your estate plan involves a thoughtful assessment of your assets, goals and family dynamics. Begin by identifying your key objectives: protecting your family, establishing your business legacy, minimizing tax liabilities, securing generational wealth or supporting charitable causes. Working with an experienced estate planning attorney is essential for sophisticated plans as well as simple strategies, as they’ll guide you through all your options like trusts, business succession strategies and tax-efficient wealth transfer methods. At Schneider Bell, we tailor our approach to meet the unique needs of every business owner and family, helping you lay a solid foundation for generations to come.

What Documentation Do I Need to Begin My Estate Plan?

To prepare for your first meeting with your estate planning attorney, gather key financial and personal documents that will form the foundation of your strategy. Gather a current list of assets and liabilities, recent tax returns, life insurance policies, business ownership documents, current beneficiary designations and any existing wills or trusts. For business owners, having corporate agreements and a detailed business succession plan is highly recommended. You’ll also need to consider healthcare directives, powers of attorney and beneficiary designations. By organizing these documents, you will enable your estate planning attorney to efficiently develop a comprehensive plan that aligns with your personal and financial goals.

Own a business? Need help with a succession plan? We have you covered. Contact us today.

Let us help you build a legacy that lasts.

With our expert estate planning team by your side, you can rest assured that every detail will be handled with precision and dedication. Are you ready to put your first estate planning session on the calendar? Contact our legal team today.